Documentation is often inadequate, with significant consequences for reimbursment

Lower payout amount

Missing documentation can lead to reductions or even repayment of accredited funding

Longer waiting time for payout

In order to receive accredited subsidies, regular queries must be made, e.g. ELSTER forms.

Extra Effort

Questions from the funding organisation regarding funding as part of a tax audit can be very time-consuming if no systematic documentation is available

In order to receive a payout as quickly as possible, hours must be documented and reporting form sent

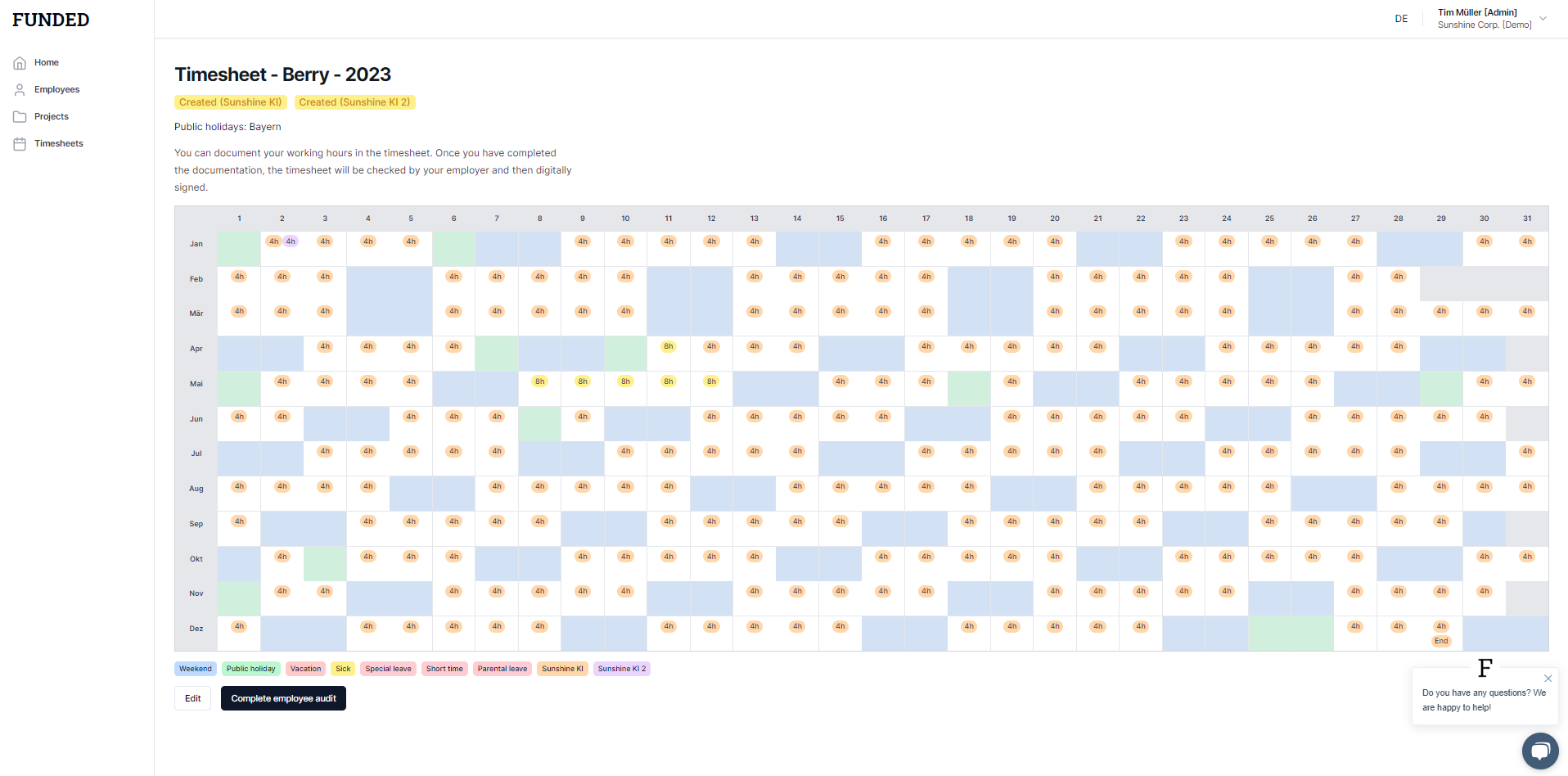

01

Hours documentation

Together with FUNDED, hours documentation is created for previous financial years. Future years can be covered using the FUNDED software

02

Reporting

Forms

Based on the hours documentation, the tax consultant/finance department fills out the reporting form "Antrag auf Forschungszulage"

03

Determination of FZul

Once the reporting form has been received, the tax office determines the research allowance. As part of this process, the tax office usually asks questions about the hours documentation

04

Corporate income tax assessment

Once the notice has been sent (by the BSFZ) and the reporting form "Forschungszulage" has been completed, the corporate income tax return can be submitted.